Buying Property in France through a Monaco SCI: Tax and Compliance Guide

Buying French Property through a Monaco SCI: Structure, Tax Rules & Annual Filings

Buying French Property through a Monaco SCI: Structure, Tax Rules & Annual Filings

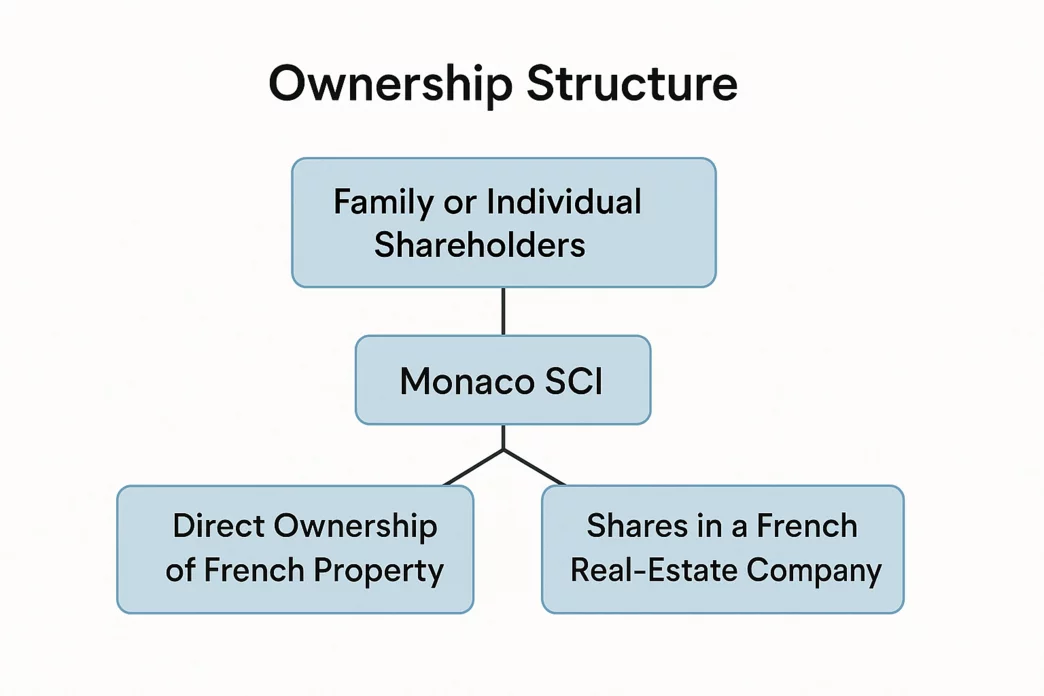

1. What Is a Monaco SCI and How It’s Used for French Property

A Société Civile under Monegasque law (SCI) is a non-commercial company designed to hold and manage assets, particularly real estate. It allows families and investors to structure ownership, governance, and succession.

A Monaco SCI must have a registered office in Monaco and comply with beneficial owner registration (RBE) and local corporate formalities.

Typical ownership structure:

- Family or individual shareholders

- Monaco SCI as holding entity

- Direct ownership of French property or shares in a French real-estate company

Main benefits: centralized ownership, defined voting rights, privacy, and simplified inheritance through share transfers instead of property division.

2. Core French Tax Rules That Still Apply

Even if property is owned through a Monaco SCI, France continues to tax French-situs assets. The structure does not move the property outside the French tax system.

a) 3% Market-Value Tax (TVVI)

All foreign or French entities owning French property directly or indirectly are subject to a 3% annual tax on market value unless they file the Form 2746-SD declaration by 15 May each year.

b) French Wealth Tax (IFI)

Shareholders subject to Impôt sur la Fortune Immobilière must include their proportional interest in French real estate, even if held via a foreign company.

c) Rental Income – Default French Income Taxation

By default, a Monaco SCI is fiscally transparent. Its French rental income is taxed in France under impôt sur le revenu (IR) at the level of each shareholder, using:

- Revenus fonciers rules for unfurnished rentals

- BIC rules for furnished rentals

If the SCI elects corporate tax (IS) status, rental profits are taxed at the 25% corporate income tax rate.

3. Annual French Filings Required for a Monaco SCI

Foreign ownership of French real estate brings annual compliance duties.

Transparent SCIs (income tax regime)

- Form 2072 – annual income declaration filed in May

- Form 2042/2044 – each partner reports their income share

- Form 2746-SD – annual disclosure to avoid the 3% market-value tax

SCIs subject to corporate tax (IS)

- Form 2065 with financial statements (within three months of year-end)

- VAT returns (CA3 / CA12) if applicable

All SCIs owning French property

- IFI declaration (Form 2042-IFI) for liable shareholders

- Form 2746-SD every year – mandatory

4. Capital Gains, Transfer Duties & Compliance Costs

- Capital gains: French-source gains taxable in France; fiscal representative required for non-EU/EEA sellers.

- Transfer duties: 5% duty applies on sale of shares in real-estate-rich companies.

- Administrative burden: annual French filings plus Monaco company formalities.

5. When to Use a Monaco SCI

A Monaco SCI suits non-French residents and international families seeking control, privacy, and succession efficiency.

For French residents, direct ownership of French property is usually more appropriate, especially if they do not plan to move abroad — the SCI offers no French tax benefit and adds complexity.

6. Key Takeaways

- France taxes French property regardless of ownership structure.

- Filing Form 2746-SD annually avoids the 3% market-value tax.

- Transparent SCIs are taxed at shareholder level under IR; IS is optional.

- French residents should prefer direct ownership if they remain domiciled in France.

Thinking of purchasing French property through a Monaco structure?

Our Monaco Properties team can connect you with trusted notaires, tax advisors and cross-border experts to structure your investment safely and efficiently.

Contact us to begin your personalised consultation.

Legal Notice:

The information provided in this article is for general informational purposes only and does not constitute legal, tax, or financial advice.

Regulations may change, and the application of tax or legal rules depends on each investor’s individual circumstances, residency, and professional advice.

Before taking any action or making any investment decision, readers should consult a qualified notaire, tax advisor, or legal professional experienced in cross-border Monaco–France matters.

Monaco Properties assumes no liability for decisions made based on the content of this publication.